On Climate Dynamism

Backing big businesses with positive externalities

🤕 Tough times for the transition

As we approach the end of the year, it’s increasingly clear that the “climate” moniker has been slapped around a fair bit in the second half of 2024.

The combination of flip-flopping European legislation, ineffective COP summits, a climate-skeptic inbound US government, an increasingly militant, rearming world, high profile European start-up failures, and the politicisation of climate by right and left-wing parties across the globe, have taken the shine of 2019-2023’s golden child.

And this is before we even engage with 2018-21 venture cash being used to pump the price competitiveness of a number of as-yet uncompetitive sectors, many of which will never look like VC returns and will cost over-exposed GPs and LPs a lot of money (and trust) in the medium term.

While this is nowhere near the cleantech collapse of the early 2010s, it is worth reflecting on what climate means to us at Earth heading into 2025, and why we have never been more bullish on our thesis as a fund - that of Climate Dynamism.

🌎 Climate Dynamism

The American Dynamism definition (per a16z) is “the spirit of innovation, progress, and resilience that drives the United States forward. This powerful force is exemplified by groundbreaking achievements in technology and innovation, shaping both our nation and the global landscape.”

While the a16z definition omits the layers of complexity surrounding current US exceptionalism, we are firm believers in the “dynamism” baked into the idea: leaning hard into one’s strengths and ignoring everything else. It’s maximalism, a focus on growth, and on pushing forward - not looking back, agonising over regulation, relying on subsidies, or aiming for anything less than massive.

For us at Earth, with GPs who are builders (5x founders, 2x unicorn founders), this means getting back to making stuff that solves real problems. Building scalable, profitable businesses. Creating superior products that are climate-positive within (or in spite of) legislatory frameworks. Backing exceptional talent coming out of top research institutions. Finding those founders with wildly contrarian viewpoints. And, crucially, only focusing on the fundamentals - relevant problems, big sectors, great products, strong incentive mechanisms and venture-scale outcomes.

To borrow from the storied folks at a16z, we define Climate Dynamism as the spirit of innovation and resilience driving solutions to the climate emergency through technology. An action-oriented force pushing the world to tackle climate change while considering business, society, and natural systems."

How this relates to climate change

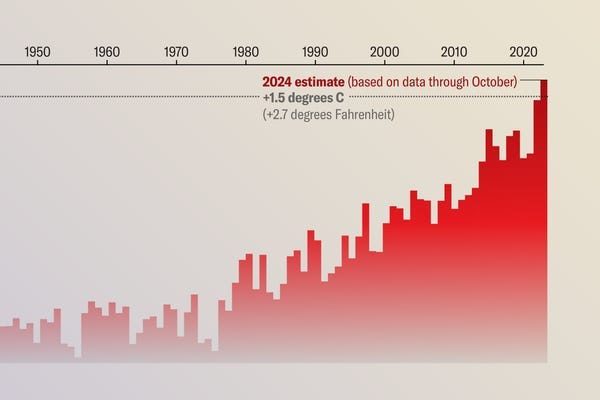

Given that it’s more or less accepted that we’ve now sailed past the 1.5 degree mark, it is increasingly clear that humans are terrible at not doing things they like doing due to a still somewhat abstract threat. So why pretend reduction is a viable approach?

As a founder-led fund we’re biased towards action - and work with entrepreneurs who embody the same principles. In an age of sclerotic governments, businesses have an outsized opportunity to push through the changes needed to build the world in which we want to live.

For us, this relates to three specific areas (the first two we stole from Nan Ransohoff’s excellent mental model for combatting climate change):

Sucking greenhouse gasses out of the atmosphere

Reducing the quantities of greenhouse gasses we use in existing processes

Preparing our world for a fast changing climate

The former remains really hard, and in most cases too far out for early-stage venture - DAC is still uncompetitive, carbon markets are chaotic and inconsistent, nature-based solutions are rarely venture-friendly, and the majority of removal questions are infrastructure problems - dependent on grants, deep investor pockets, and patient corporates. Few will fit a 10+2 fund cycle (although we’re obviously keeping a keen eye on those that will).

But the latter two areas provide much more fertile hunting ground for early-stage funds. The reduction of emissions is now at least a secondary question in basically all industries. Speaking to the founder of a chemical process-focused start-up this week, they cited that the majority of large chemical players are looking at the environmental impact of their processes as a primary consideration.

This is the same across everything from urban travel to consumer goods to fertilisers - because of regulation, yes, but also stakeholder pressure, the reality of the cost competitiveness of clean energy, and the tipping point towards fossil fuel based solutions no longer being a realistic long-term strategy.

While the reduction of emissions, carbon capture, change of industrial processes, protection and regeneration of the biosphere, and more are occurring, two other things will happen: the climate will get hotter and it will get more unpredictable. That’s where we see a huge need for adaptation technologies to get us through the coming decades. So “the long-view” can actually happen.

🤖 Tech for the new economy

Technology has an incredible role to play in these areas - and this is where we’re spending our time. We love businesses localising manufacturing to shorten supply chains and reduce waste (see Isembard, Saeki, Kaikaku), reducing inefficiencies in industrial processes (Cradle, Solve Chemistry, Elio, CarbonRe, Foresight Data Machines), mapping water loss to mitigate the 20% lost in pipes [in the UK] (FIDO AI, Hulo AI, ManholeMetrics), live-tracking water usage in precision agriculture (Gardin, HexaFarms) or monetising excess industrial heat to charge batteries (Electrified Thermal Solutions).

This is the tip of the iceberg - the key factor here is that all of these businesses are focused on cost and process efficiency, with the environmental effects as a benefit. In a politically unstable world, where priorities sharpen and harden in cortisol-driven decision-makers, cash is king.

And in terms of the third pillar - climate resilience, the space broadens to include a number of adjacent markets. This includes everything from editing crop DNA for greater resilience or efficiency (Phytoform Labs, Biographica), through up-skilling workforces for the energy transition (Montamo, Smalt), short-term weather modelling for disaster planning (Silurian), or longer hedges like the potential that Europe moves towards variable water markets (such as that seen in Israel), ushering in a role for water future or water credits. We also love climate risk modelling for asset managers (Climate X, Telescope), financial plays around funding the energy transition, and tools to enable retrofitting at scale (mapmortar, Ecoworks).

There is no philanthropy here, and we’re wary of any businesses driven by regulation (that are ultimately subject to the whims of yoyo-ing governments). Instead - by taking a +ten-year view on where we believe the world is going (something we’ll explore in deeper posts in the coming weeks) and working backwards, the quantity of climate focused, or climate adjacent opportunities, in spaces with already proven technologies, relevant corporates for exit opportunities, public companies trading at decent multiples, and European technology competitiveness is considerable.

👩🍳 Still cooking…

And lastly, of course we’re keeping a very keen eye on those spaces where today regulation and subsidies are providing the necessary push towards competitiveness, but we can clearly see self-sustained and profitable climate solutions on the horizon.

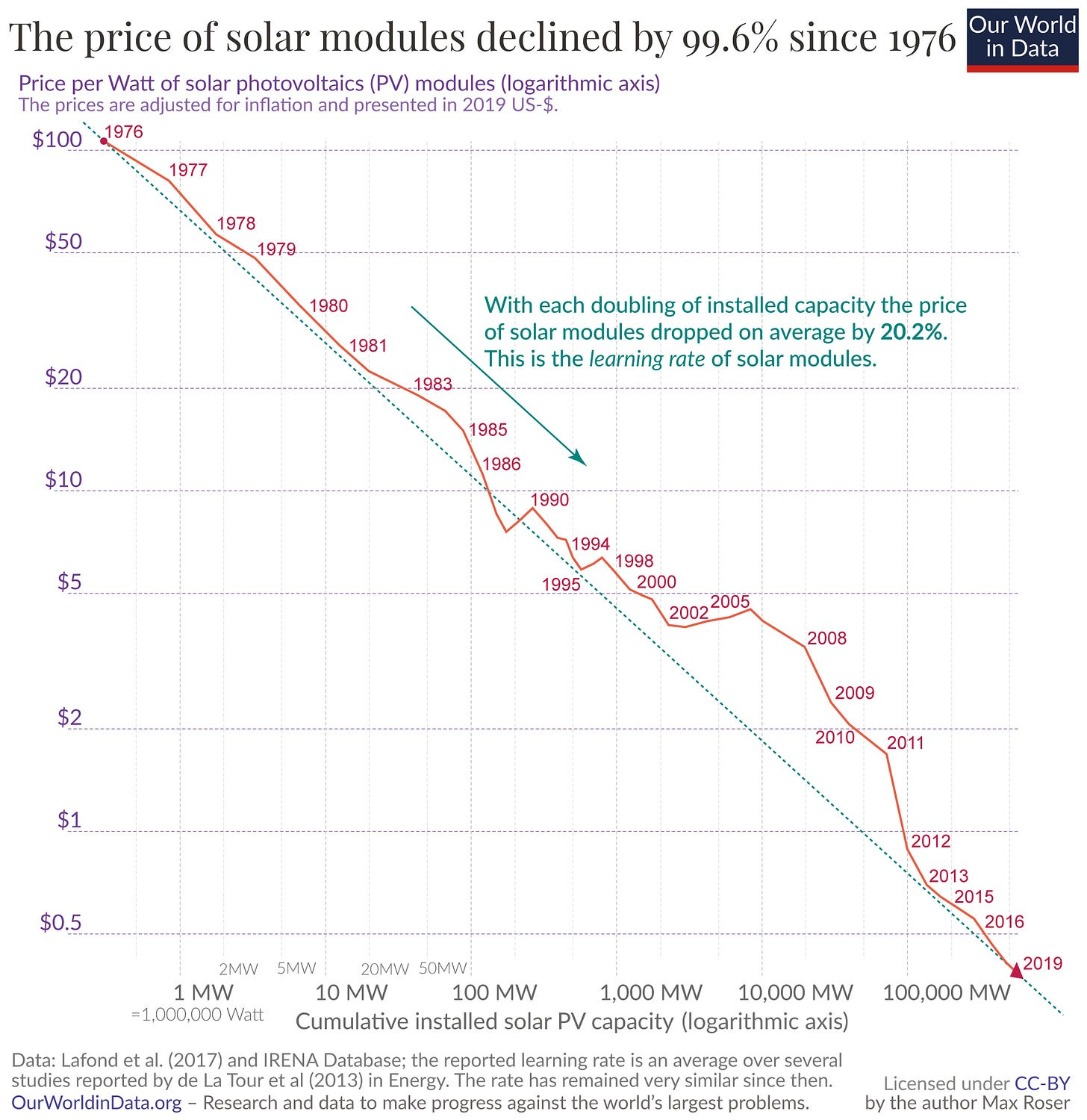

By this point the learning curves seen in solar (and now in batteries) are well known, and the green infrastructure roll-out is picking up pace - as Blackrock’s Investment Institution predicted this week, “meeting growing energy demand (think solar farms, power grids, oil and gas) will generate investment of US$3.5 trillion per year this decade”.

We’re watching adjacent spaces for similar moves towards commercial viability or mass adoption (e.g. SAF/carbon markets/biodiversity/compliance markets/battery recycling/anything EV) where this is coming, or indeed in those spaces where specific opportunities unlock previously unseen arbitrage (crypto mining using solar, done by Anadro, solar powered synthetic fuel plants via Rivan, or solar-driven desalination for example).

LFG 🚀

As such, while the present may not feel super bright for the “climate” space, by disabusing ourselves of the notion that “climate tech” = carbon credits, regulatory compliance and uncompetitive, hard to scale science moonshots, we can build a hugely exciting and economically viable space in which to invest in companies that will last beyond the 21st century

Here’s to 2025 - we know we’re ready, and we invite you to jump on board.

Want to discuss further? Drop Max a note.

shortx.io